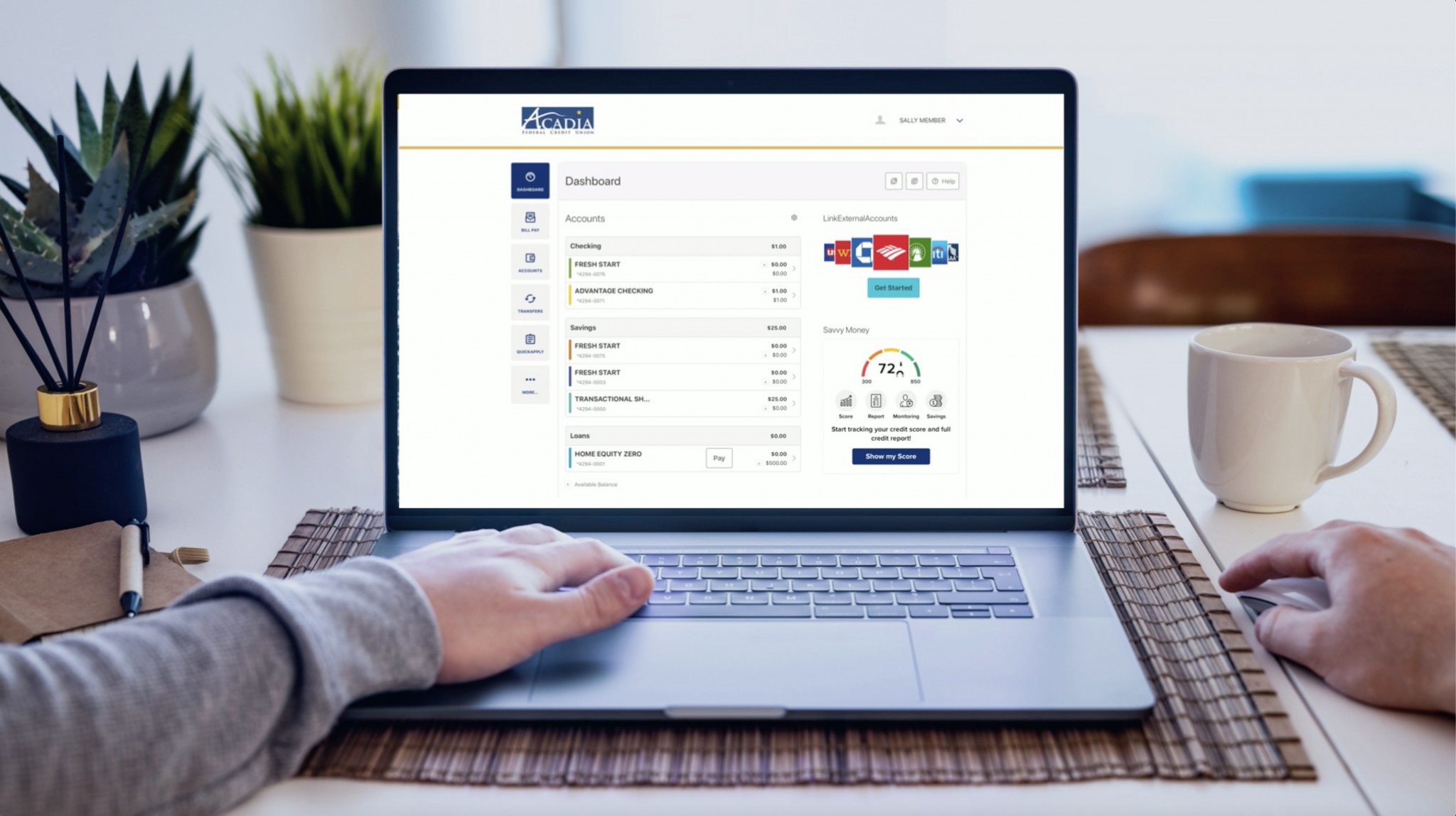

Digital Banking with Acadia

This Digital Banking Experience offers the ultimate in speed, security, and evolving functionality, with all the features you would expect and more!

This Digital Banking Experience offers the ultimate in speed, security, and evolving functionality, with all the features you would expect and more!

Take a tour of the login process of our new and improved Digital Banking Experience. See for yourself just how easy it is!

Coming soon.

In mid-to-late August, we will launch our new Digital Banking Experience.

Confirm that you know your current Online Banking username and that your email, phone number, and address on file are up-to-date.

Check out our registered user login tutorial and see just how easy it will be to transition to our new Digital Banking Experience!

Register for your new Digital Banking Experience by clicking “Login” at the upper right corner of this website. Mobile banking users will need to update or download the AcadiaGO mobile app.

Online Banking is any form of personal banking which you conduct using the Internet – many of you do this already. While Online Banking only deals with the essential transactions – the nuts and bolts, Digital Banking goes much deeper – more “big picture” and requires a comprehensive re-engineering of Acadia’s internal systems. Online Banking is essentially one facet of Digital Banking, since Digital Banking expands beyond the nuts and bolts and simple actions of Online Banking by offering increased mobility and feature-laden transactions.

In a nutshell, it’s what you’re already doing, but WAY better!

Around the end of August 2021, Acadia FCU will roll our current Online Banking and AcadiaGO mobile banking into the same, seamless Digital Banking experience — with all the features you would expect to have in both!

Acadia FCU is committed to providing technology to help our members better manage their finances. This upgrade in service will modernize our digital infrastructure, offering the ultimate in speed, security, and evolving functionality – providing an improved experience compared to what we offer today.

Switching between devices will deliver a seamless experience and provide you with a robust interface that is faster, simpler, and easier to use. We are excited for you to experience all of this, along with upgraded security, integrated budgets, goals and trends, credit score monitoring, advanced search, alerts, and much more.

We will have new features such as:

It is our pleasure to present our members with a seamless experience, making your Digital Banking experience with Acadia FCU the best that it can be!

You will need to know your username, email address, and zip code. This information must be the same as what we have on file, so please be sure your most current information is in your account. Please call 1-855-692-2234 or click the Live Support bubble in the lower right corner of our website to verify your information or if you do not know your current username.

No. If you are the primary account holder, your online banking account will carry over and you will be able to log in with your existing username. You will need to create a new 10-character (or greater) password. Click here to see step-by-step instructions.

Yes, you will need to create a new password with minimum of 10 characters, but on the bright side – you’ll only need to change it once per year!

Some of our suggestions regarding creating your new, minimum 10-character password are:

Also known as your share account number, this number can be found on the member ID card you received upon opening your Acadia FCU account. You may also find this number on the top right-hand corner of your monthly statement. Your membership account number is NOT the long number located at the bottom of your checks – that is your MICR number.

Your MICR number is the long number located at the bottom of your checks and is used for setting up direct deposits and automatic withdrawals from your accounts. This is not the same as your account number.

Yes. Upon registration, you will establish your own username and password. Going forward, each member will have their own username and password, allowing members to see accounts associated with their Social Security Number (SSN) or Employer Identification Number (EIN). Keep in mind that upon registering under the new Digital Banking platform, you will likely see more accounts listed that you did before, since you will have access to anything your SSN or EIN is attached to.

If you are the primary owner of the account, your name will appear at the top of the statement, and any joint owner will be listed at the top of the “Statement Detail” section.

Once our upgrade to Digital Banking is complete, you will have the ability to unlock yourself after hours, without the help of an Acadia FCU staff member.

Clicking either “forgot username” or “forgot password” will offer guided steps and two-factor authentication to allow for a member-controlled unlock, even after you’ve used up all five attempts to log in. If you prefer to contact us if you find yourself locked out, please feel free to do so using one of our many contact methods and we’ll get back to you as soon as we can during regular business hours

Yes. You will have to set up that member in your transfer options. Click “Transfer to Another Acadia FCU Member.” Once you enter their name, account number, and share ID and select “Save Account for Future Use,” you will be able to transfer funds now – and in the future – without needing to re-enter the information. If it’s a one-time transfer, simply do not “Save Account for Future Use.”

Our new Digital Banking experience is “member centric” which means that you will see any account information that your SSN or EIN is attached to. In the past, joint account holders did not “see” this information in their Online Banking portal unless they specifically asked for that visibility.

If there is an account you are not seeing, please contact us using the “Live Support” button on our website or by calling 1-855-692-2234. We’ll be happy to assist.

If you currently use Bill Pay and are the primary account holder, all account information will carry over. We plan for a seamless transition! If by chance your Bill Pay info doesn’t seem quite right, please contact us by clicking “Live Support” in the bottom right corner of our website or by calling 1-855-692-22345 and we’ll help you out.

The current version of AcadiaGO will be disabled and you will need to download the latest version. If you’re using an Apple device with automatic updates, your mobile app will be updated. If you are set up to update manually, you can simply visit the AppStore and download AcadiaGO yourself.

Android users will need to uninstall AcadiaGO and download the new version from the Google Play store.

Yes, you will be able to enable biometrics for sign in purposes if you wish.

Yes, you can access Digital Banking using any of the supported browsers (within the two latest versions): Google Chrome, Microsoft Edge, Firefox or Safari.

You may click on either “Forgot username” or “Forgot Password” and follow the steps, anytime of the day or night

We’re excited to say YES, you will have the ability to unlock yourself after hours, without the help of an Acadia FCU staff member. Our Digital Banking upgrade is meant to be self-service, for those who prefer a hands-on approach! Clicking either “forgot username” or “forgot password” will offer guided steps and two-factor authentication to allow for a member-controlled unlock, even after you’ve failed all five attempts to log in.

Unfortunately, your eAlerts will not carry over. You will need to set them up again, which you can do by going to “settings” then “notifications.”

If you are currently enrolled to receive eStatements, you will find them in the eDocuments widget. If you are not currently enrolled to receive eStatements, simply sign up through the eDocuments widget, located within the “More” widget on the left sidebar

You sure can! Simply click “Transfers” and then “Add External Account (ACH)” and follow the steps to complete setup.

The routing number is located at the bottom of the page from your desktop computer or if you’re using a browser from your mobile device. AcadiaGO mobile app users will find the routing number behind the “more” widget. Acadia FCU’s routing number is 211287748.

Select your loan and click “Pay” for loan payment details.

Click on the “Transfers” widget, select the account the transfer will come from, and the account it will go to, then type the amount of the transfer. Enter the rest of the relevant information such as the beginning date frequency and end date. Confirm the transfer and you’ll receive confirmation that it was successful.

Acadia FCU members can opt-in to “Savvy Money,” a comprehensive credit score program offered for free. You can now closely monitor credit activity using without negatively affecting your score and stay on top of your credit. You’ll learn about what’s impacting your credit score and how you can improve it. Furthermore, “Savvy Money” will alert you of any major changes or suspicious activity on your credit report.

Quickbooks users will enjoy full integration with our Digital Banking platform, connecting directly to your account to pull transactions directly into Quickbooks with no additional steps needed. Quicken users will have the ability to import/export a file manually into their software.

You certainly can! Widgets are customizable from “Widget Options” on your desktop computer or under “Navigation” if using the AcadiaGO mobile app.

When you select “hide an account,” it is hidden from your dashboard and the accounts widget. The only way you will be able to view it is when you click on “Settings” and then “Accounts”. Accounts that are hidden can be changed at any time.

All account nicknames and colors are customizable with this upgrade by going to “settings” and then “accounts.” Changing the account name and color code makes it super-easy to quickly identify accounts, especially for anyone who has multiple primary or joint accounts.

On a desktop PC or if you’re using a browser on a mobile device, simply select the account name you want to change, then click the pencil to the right of the name. Change the name and/or color, then select “Save.”

From the AcadiaGO mobile app, click “more” in the lower right corner, then select “others” from bottom of the menu, then choose “settings.” Click “accounts,” then select the account you want to change, and click the pencil to the right of the name to make the changes. Don’t forget to click “save” in the upper right corner.

Voluptatibus dolore delectus sit maxime quo nobis mollitia. Beatae occaecati odio sint ab et optio quaerat et. Quis ratione voluptate placeat aut.